Get up to $100 cash1

in your pocket for switching to a Flatwater Bank checking account. We make it easy to bank with us. Open an account online, or if you are in Ansley, Brady, or Gothenburg, stop in one of our convenient locations. See all terms and conditions.

OPEN A NEW FLATWATER BANK CHECKING ACCOUNT & GET $1001!

It's our way of saying 'Welcome and thank you for choosing a checking account that prioritizes YOU.'

GET BETTER BANKING IN THREE EASY STEPS:

Open a New Account

Open a New Account

Open a new Flatwater Bank Consumer Checking account that best fits your needs by August 31, 2025.1

Enter “Get100” if opening online or mention the promotion when opening at any branch.

Open Now![]()

Meet the Requirements

by having 10 debit card purchases by the end of the first statement cycle.1

Enjoy Your Bonus

get $100 deposited in your account.1

Choose the account that best fits your needs:

MOST POPULAR |

EARNS INTEREST |

PREMIUM |

|

Essential Checking $100 Bonus1An account with all the essentials and no minimum balance.^

|

Pioneer Checking $100 Bonus1Earn interest with a low minimum account balance.

|

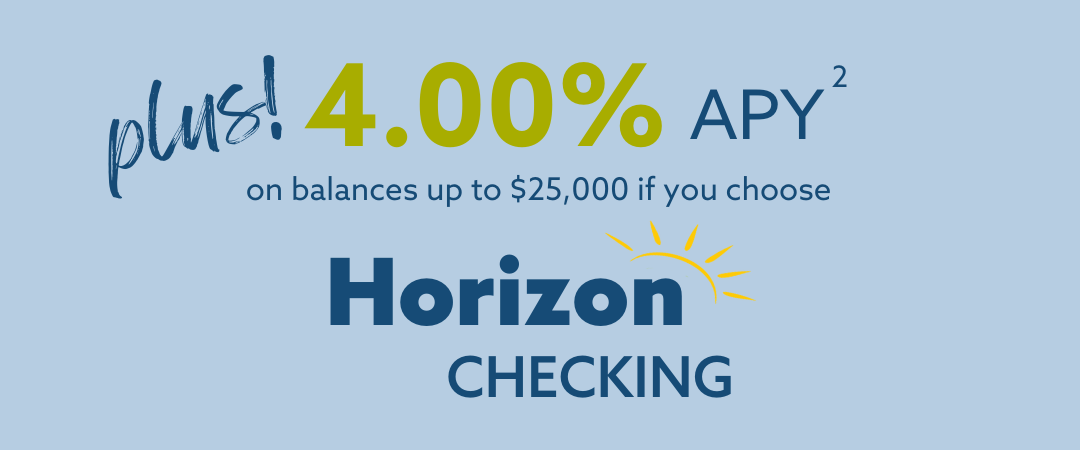

Horizon $100 Bonus1A high value account with expanded benefits and premium interest.

|

|

|

|

|

Plus, all of our consumer checking accounts

include the following features:

- Online & Mobile Banking with Bill Pay

- My Credit Manager on going credit monitoring

- Instant Issue Visa Debit Card with fraud monitoring

- Round-Up Savings Plan Option

- Online Statements with Check Images ^

- ID Theft Assistance

- Low Opening Balance ($50)

Terms & Conditions

- Bonus is for new consumer checking customers who open a consumer checking account by 8/31/2025 and meet bonus requirements. Limit one bonus per person and account. Bonus criteria: The account must be in good standing. Enter “Get100” if opening online or mention the promotion when opening at any branch. Must have ten debit card purchases by the end of the first full statement cycle following the account opening. Bonus will be credited to account within 15 days of the first full statement cycle ending.

- 4.00% annual percentage yield on Horizon Checking. To qualify for this rate, account must have at least 1 direct deposit or electronic debit (ACH), and at least 10 debit card purchases with a minimum of $1 per transaction per statement cycle. If qualifications are not met, and for balances above $25,000, the rate will be 0.15% APY. $10 maintenance fee if balance falls below $2,500. 0.25% APY on Pioneer Checking. To qualify for this rate, account must have at least 1 direct deposit or electronic debit (ACH), and at least 5 debit card purchases with a minimum of $1 per transaction per statement cycle. $5 maintenance fee if balance falls below $500. Rates are effective 05/15/2025. Rates are subject to change. Fees may reduce earnings. No minimum balance to obtain stated APY. Minimum to open account is $50.

^Free online statements or $2 for paper statements (Waived for active military, veterans, and customers age 55 years or older. Please contact the bank to receive this benefit.

- No Minimum Balance

- No Monthly Service Charge

- Foreign ATM Fees: 3 FREE Per Statement Cycle 1

- Online Statements: FREE 2

1 A Foreign ATM Fee is charged for all foreign ATM transactions which are withdrawals, deposits, transfers, or inquiries at an ATM terminal other than a Flatwater Bank terminal. 3 Foreign ATM Fees will automatically be rebated at the end of the statement cycle. See our Service Charges & Fees Schedule for cost of Foreign ATM Fee.

- Complimentary Box of Personalized Checks1

- Competitive Interest

- Foreign ATM Fees: 6 FREE Per Statement Cycle 2

- Foreign ATM Service Charge Rebate: $5 Per Statement Cycle 3

- Bonus Rate on CD: +.50% Above Posted Rates 4

- Consumer Loan Rate Discount: .25% 5

- Safe Deposit Box: 1 Year FREE on New Rentals

- Sweep Fee: 1 Per Year WAIVED Upon Customer Request

- Minimum Balance: $500 to Avoid $5 Maintenance Fee Per Statement

1 Specialty gray single copy checks

5 For new loans only. Requires automatic debit on loan payment.

- Our Highest Interest Checking Account

- Complimentary Box of Personalized Checks1

- School Spirit Debit Card: FREE

- Foreign ATM Fees: 12 FREE Per Statement Cycle 2

- Foreign ATM Service Charge Rebate: $10 Per Statement Cycle 3

- Bonus Rate on CD: +.50% Above Posted Rates 4

- Consumer Loan Rate Discount: .25% 5

- Safe Deposit Box: 1 Year FREE on New Rentals

- Sweep Fee: 2 Per Year WAIVED Upon Customer Request

- Stop Payment Fee: 2 Per Year WAIVED Upon Customer Request

- Money Orders: FREE

- Minimum Balance: $2,500 to Avoid $10 Maintenance Fee Per Statement

4 For new CDs only. Excludes CD specials .

5 For new loans only. Requires automatic debit on loan payment.