Spot a Scam Like a Pro

Every day, thousands of people fall victim to fraudulent emails, texts and calls from scammers pretending to be their bank. Flatwater Bank has joined with the American Bankers Association to help you spot phishing scams and protect your accounts.

Banks Never Ask That

We want every bank customer to become a pro at spotting a phishing scam, and it starts with these four words: Banks Never Ask That. When you know what sounds suspicious, you're less likely to be fooled.

Questions Flatwater Bank Would Never Ask

There are a series of questions that would make sense for your bank to ask you, but the threat of a scammer can be spotted by how you are contacted and the questions that are asked by the bank representative. Banks communicate with their customers in a few ways, however it’s not normal for them to send an email or text message that asks you for account information, to call them or to click on a link to avoid any account issues.

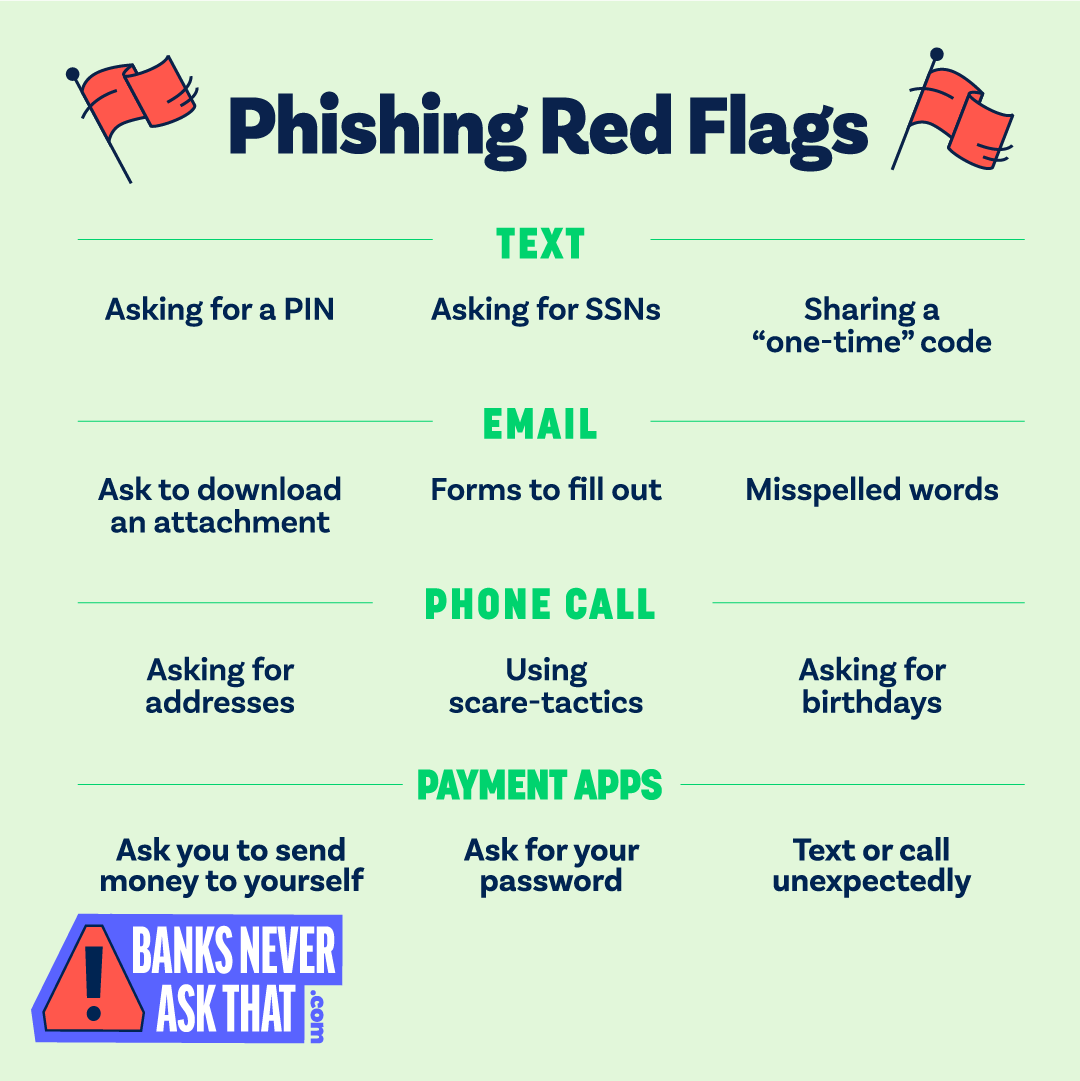

The 4 phishing scams are full of read flags:

- Text Message: If you receive a text message from someone claiming to be your bank asking you to sign in, or offer up your personal information, it’s a scam. Banks never ask that.

- Email: Watch out for emails that ask you to click a suspicious link or provide personal information. The sender may claim to be someone from you bank, but it’s a scam. Banks never ask that.

- Phone Call: Would your bank ever call you to verify your account number? No! Banks never ask that. If you’re ever in doubt that the caller is legitimate, just hang up and call the bank directly at a number you trust.

- Payment Apps: Beware of text messages from someone claiming to be your bank saying your account has been hacked. The scammer may ask you to send money to a new account they’ve created for you, but that’s a scam! Banks Never Ask That.

You’ve probably seen some of these scams before. But that doesn’t stop a scammer from trying. For more tips and videos to help you keep phishing criminals at bay, visit www.BanksNeverAskThat.com. And be sure to share the webpage with your friends and family.

What to do if you fall for a scam?

What to do if you are a victim

Call your bank and credit card issuers immediately so they can take action. At Flatwater Bank we offer Identity Theft Services to help those who think they may have become a victim of ID theft. If you think you are a victim, give us a call, we are here to help. Depending on your situation, we will put you in contact with a fraud resolution specialist. They can help with the following:

- Spotting if a Child's Identity Has Been Stolen

- Replacing Important Documents After a Disaster

- Placing Active-duty Fraud Alerts for Military Service

- Resolving Medical Fraud

- Limiting Damages from Stolen or Compromised Data

- Preventing Criminals from Using Your Name for Employment

- Fighting Tax Fraud to Clear Your Name and Secure Your Refund

- Resolving Unauthorized Account Activity or Account Takeover

- Power of Attorney or Legal Guardianship Questions for Elderly Family Members

For news on the latest identity scams and access to a wealth of resources and proactive tips to help you avoid becoming a victim, visit our insider tips page.