Managing Credit Effectively with MyCreditManager

Understanding Credit Management

Managing credit means understanding how credit works, how to use it wisely, and how to keep track of your credit score and history. Your credit score is a numerical representation of your creditworthiness, based on your borrowing and repayment behavior. Creditors, lenders, and financial institutions use this score to assess the risk of lending you money or providing services.

Good credit management involves:

- Regularly monitoring your credit reports to ensure there are no inaccuracies or fraudulent activities.Paying bills on time since payment history is the most significant factor affecting your credit score.

- Keeping credit utilization low by not using too much of your available credit.

- Avoiding too many hard inquiries within a short period, as this can indicate financial distress.

- Maintaining a healthy mix of credit accounts, including revolving credit (like credit cards) and installment loans (like car loans or mortgages).

Why is Credit Management Important?

- Lower Interest Rates: A higher credit score leads to lower interest rates on loans and credit cards.

- Increased Approval Chances: Lenders are more likely to approve loan or credit card applications from individuals with strong credit profiles.

- Better Loan Terms: Good credit can lead to better loan terms, including higher borrowing limits and more flexible repayment options.

- Financial Security: Proper credit management prevents you from falling into debt traps, where high-interest payments on overdue loans lead to financial hardship.

- Housing and Employment Opportunities: Landlords and some employers check credit scores as part of their decision-making processes.

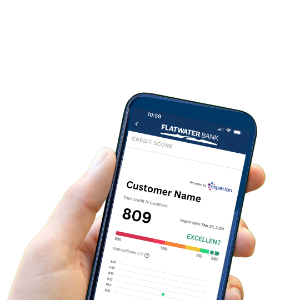

MyCreditManager Can Help.png)

- Access to Your Credit Report. Using My Credit Manager, you have access to view a complete credit report from Experian, including all payment history.

- See Your Credit Score. MyCreditManager provides real-time access to your credit score from one of the major credit bureaus. This allows you to:

- Track changes in your credit score regularly.

- Get insights into what factors are helping or hurting your score.

- Detect potential fraud early by monitoring any sudden or unexpected changes.

- Credit Score Simulator. MyCreditManager provides you with information on how your score is affected by certain actions, such as opening a new credit card or taking out a loan.

- Change in Credit Alerts. You will receive notifications when your credit score or report changes, so that you can continue to monitor your credit and ensure your report is accurate.

Managing credit effectively is a key part of achieving financial stability. MyCreditManager provides all the tools and insights necessary to take control of your credit health and ensure your financial future remains secure. Whether you’re looking to improve your credit score, monitor your accounts for errors, or learn more about credit management, this platform is a comprehensive solution for all your credit needs. By incorporating MyCreditManager into your routine, you can protect your financial health and build a strong credit profile that opens doors to financial opportunities that will aid your long-term financial success.