Why Tax Planning Should Start Early in the Year

Despite the common misconception that tax planning occurs at year-end, it's critical to start the process at the beginning of the year. Planning early offers several benefits that may significantly reduce time and financial complications later. Here are seven reasons for starting tax planning now.

1. Optimal utilization of tax deductions and credits

With early tax planning, there is ample time to identify and take advantage of available tax deductions and credits. Throughout the year, maintain records of potential deductions, such as education expenses, mortgage interest, and medical expenses. Additionally, tax credits for energy-saving home improvements or contributions to retirement accounts can be maximized when planned for in advance.

2. Cash flow management

Starting tax planning early allows one to estimate one's tax liability for the year. This foresight allows the setting aside of necessary funds, improving the overall cash flow management. A comprehensive financial plan can help prepare to meet tax obligations without last-minute scrambling.

While many have payroll tax deductions through their employer, self-employed individuals must be aware of their quarterly tax obligations. Working with financial and tax professionals can help these individuals determine an appropriate tax payment strategy for their situation.

3. Reduction of taxable income

Early planning also offers the opportunity to reduce taxable income. By contributing to a tax-deferred retirement fund or health savings account (HSA), for example, one can lower one's overall taxable income.

4. Avoiding penalties and interest

Failing to pay taxes on time can result in heavy penalties and interest. Early tax planning helps avoid unnecessary costs by preparing for timely tax filings. If taxes are due and there is no cash reserve to pay immediately, filing a payment agreement form at the time of filing can be helpful. This process also reduces the chances of discrepancies that might attract additional scrutiny from the tax authorities.

5. Ample time for professional guidance

Tax laws and regulations are often complex and regularly updated. By starting tax planning early, one has ample time to seek professional guidance, understand the implications of new tax laws, and implement tax-saving strategies.

6. Strategic investment decisions

Tax planning can influence investment decisions as certain investments carry tax implications. For example, selling one investment may generate capital gains, while selling another may result in a deductible loss. Early tax planning provides investors time to make strategic decisions deliberately, rather than rushing at the end of the year.

7. Proactive Planning

Finally, early tax planning provides reassurance. Tax season can be stressful, particularly if left to the last minute. By preparing a tax strategy from the start of the year, one can alleviate stress and approach tax season with confidence and ease.

Let's Team Up

In conclusion, tax planning is an ongoing, quarter-by-quarter process rather than a last-minute activity. By working with financial and tax professionals, investors can prepare throughout the year to maximize deductions, reduce their taxable income, and implement tax-saving strategies to help manage their wealth.

The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendations for any individual.

This material was prepared by Nathan Wyatt for the Investment Service Center’s use.

Investing involves risks, including the loss of principal.

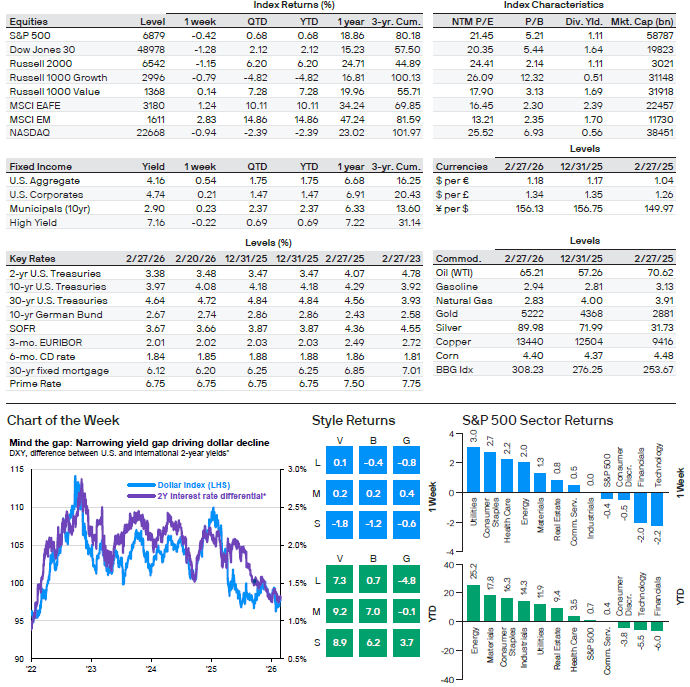

After declining over 9% last year, marking its worst performance since 2017, the dollar has remained under pressure this year. Investors are questioning whether this reflects a structural shift away from the U.S. and how they should position portfolios.

A recent Bank for International Settlements report suggests demand for U.S. assets has largely held steady. What has changed is how foreign investors hold these assets. For years after the GFC, they bought U.S. assets unhedged, riding the wave of dollar appreciation. However, increased uncertainty, especially after shifts in U.S. trade policy, has led many to raise hedge ratios, putting downward pressure on the greenback. So, it was more ‘Hedge America’ than ‘Sell America’ that drove the dollar down.

Additionally, the narrowing in interest rate differentials, as shown in the chart of the week, has contributed to the dollar’s weakness. The 2-year yield reflects market expectations for the policy path. Currently, markets are pricing in 25 to 50bps of Fed cuts this year, while the Bank of Japan and Reserve Bank of Australia are expected to hike. If policy outcomes exceed what’s priced in, the yield differential could compress further, adding pressure on the dollar.

Lastly, even after its recent slide, the dollar remains about 35% above its GFC lows. This suggests the administration may be comfortable with some additional weakness, particularly as it would support efforts to narrow the trade deficit. For investors, a softer dollar could amplify returns abroad, strengthening the case for international diversification at a time when portfolios remain heavily tilted toward the U.S.

Chart of the Week: Source: BIS, Bloomberg, FactSet, J.P. Morgan Asset Management.

*Interest rate differential is the difference between the 2-year U.S. Treasury yield and a basket of the 2-year yields of each major trading partner (Australia, Canada, eurozone, Japan, Sweden, Switzerland and UK). Weights in the basket are calculated using the 2-year average of total government bonds outstanding in each region. Data show history from Jan 1, 2022 to Feb 27, 2026.

Thought of the Week: Source: BIS, Bloomberg, FactSet, J.P. Morgan Asset Management.

Index: Institute for Supply Management Manufacturing Index; PCE: Personal consumption expenditures; Philly Fed Survey: Philadelphia Fed Business Outlook Survey; PMI: Purchasing Managers' Manufacturing Index; PPI: Producer Price Index; SAAR: Seasonally

Adjusted Annual Rate

MSCI EAFE is a Morgan Stanley Capital International Index that is designed to measure the performance of the developed stock markets of Europe, Australasia, and the Far East.

Bond Returns: All returns represent total return. Index: Bloomberg US Aggregate; provided by: Bloomberg Capital. Index: Bloomberg Investment Grade Credit; provided by: Bloomberg Capital. Index: Bloomberg Municipal Bond 10 Yr; provided by: Blomberg Capital. Index: Bloomberg Capital High Yield Index; provided by: Bloomberg Capital.

Key Interest Rates: 2 Year Treasury, FactSet; 10 Year Treasury, FactSet; 30 Year Treasury, FactSet; 10 Year German Bund, FactSet. 3 Month LIBOR, British Bankers’ Association; 3 Month EURIBOR, European Banking Federation; 6 Month CD, Federal Reserve; 30 Year Mortgage, Mortgage Bankers Association (MBA); Prime Rate: Federal Reserve.

Commodities: Gold, FactSet; Crude Oil (WTI), FactSet; Gasoline, FactSet; Natural Gas, FactSet; Silver, FactSet; Copper, FactSet; Corn, FactSet. Bloomberg Commodity Index (BBG Idx), Bloomberg Finance L.P.

information from FactSet's Pricing database as provided by MSCI. Russell 1000 Value Index,

Style Returns: Style box returns based on Russell Indexes with the exception of the Large-Cap Blend box, which reflects the S&P 500 Index. All values are cumulative total return for stated period including the reinvestment of dividends. The Index used from L to R,

top to bottomare: Russell 1000 Value Index (Measures the performance of those Russell 1000 companies with lower price-to book ratios and lower forecasted growth values), S&P 500 Index (Index represents the 500 Large Cap portion of the stockmarket, and

is comprised of 500 stocks as selected by the S&P Index Committee), Russell 1000 Growth Index (Measures the performance of those Russell 1000 companies with higher price-to-book ratios and higher forecasted growth values), Russell Mid Cap Value Index (Measures

the performance of those Russell Mid Cap companies with lower price-to-book ratios and lower forecasted growth values), Russell Mid Cap Index (The Russell Midcap Index includes the smallest 800 securities in the Russell 1000), Russell Mid Cap Growth Index (Measures the performance of those Russell Mid Cap companies with higher price-to-book ratios and higher forecasted growth values), Russell 2000 Value Index (Measures the performance of those Russell 2000 companies with lower price-to-book ratios and lower forecasted growth values), Russell 2000 Index (The Russell 2000 includes the smallest 2000 securities in the Russell 3000), Russell 2000 Growth Index (Measures the performance of those Russell

2000 companies with higher price-to-book ratios and higher forecasted growth values).

Past performance does not guarantee future results.

The J.P. Morgan Asset Management Market Insights and Portfolio Insights programs, as non-independent research, have not been prepared in accordance with legal requirements designed to promote the independence of investment research, nor are they subject to any prohibition on dealing ahead of the dissemination of investment research.

This document is a general communication being provided for informational purposes only. It is educational in nature and not designed to be taken as advice or a recommendation for any specific investment product, strategy, plan feature or other purpose in any

jurisdiction, nor is it a commitment from J.P. Morgan Asset Management or any of its subsidiaries to participate in any of the transactions mentioned herein. Any examples used are generic, hypothetical and for illustration purposes only. This material does not contain sufficient information to support an investment decision and it should not be relied upon by you in evaluating the merits of investing in any securities or products. In addition, users should make an independent assessment of the legal, regulatory, tax, credit, and accounting implications and determine, together with their own financial professional, if any investment mentioned herein is believed to be appropriate to their personal goals. Investors should ensure that they obtain all available relevant information before making any investment. Any forecasts, figures, opinions or investment techniques and strategies set out are for information purposes only, based on certain assumptions and current market conditions and are subject to change without prior notice. All information presented herein is considered to be accurate at the time of production, but no warranty of accuracy is given and no liability in respect of any error or omission is accepted. It should be noted that investment involves risks, the value of investments and the income from them may fluctuate in accordance with market conditions and taxation agreements and investors may not get back the full amount invested. Both past performance and yields are not reliable indicators of current and future results.

J.P. Morgan Asset Management is the brand for the asset management business of JPMorgan Chase & Co. and its affiliates worldwide.

Telephone calls and electronic communications may be monitored and/or recorded.

Personal data will be collected, stored and processed by J.P. Morgan Asset Management in accordance with our privacy policies at https://www.jpmorgan.com/privacy.

This communication is issued by the following entities:

In the United States, by J.P. Morgan Investment Management Inc. or J.P. Morgan Alternative Asset Management, Inc., both regulated by the Securities and Exchange Commission; in Latin America, for intended recipients’ use only, by local J.P. Morgan entities, as the case may be.; in Canada, for institutional clients’ use only, by JPMorgan Asset Management (Canada) Inc., which is a registered Portfolio Manager and Exempt Market Dealer in all Canadian provinces and territories except the Yukon and is also registered as an Investment Fund Manager in British Columbia, Ontario, Quebec and Newfoundland and Labrador.

If you are a person with a disability and need additional support in viewing the material, please call us at 1-800-343-1113 for assistance.

Copyright 2026 JPMorgan Chase & Co. All rights reserved.

©JPMorgan Chase & Co., March 2026.

Unless otherwise stated, all data is as of March 2, 2026 or as of most recently available.

0903c02a81dbac80

| Not Insured by FDIC or Any Other Government Agency | Not Bank Guaranteed | Not Bank Deposits or Obligations | May Lose Value |

|---|